Loan Service Providers: Your Trusted Financial Partners

Loan Service Providers: Your Trusted Financial Partners

Blog Article

Discover Reliable Loan Providers for All Your Financial Requirements

In browsing the huge landscape of monetary solutions, discovering reliable finance suppliers that provide to your particular requirements can be a daunting task. Let's explore some crucial factors to take into consideration when looking for out lending services that are not just trusted yet likewise customized to fulfill your distinct monetary requirements.

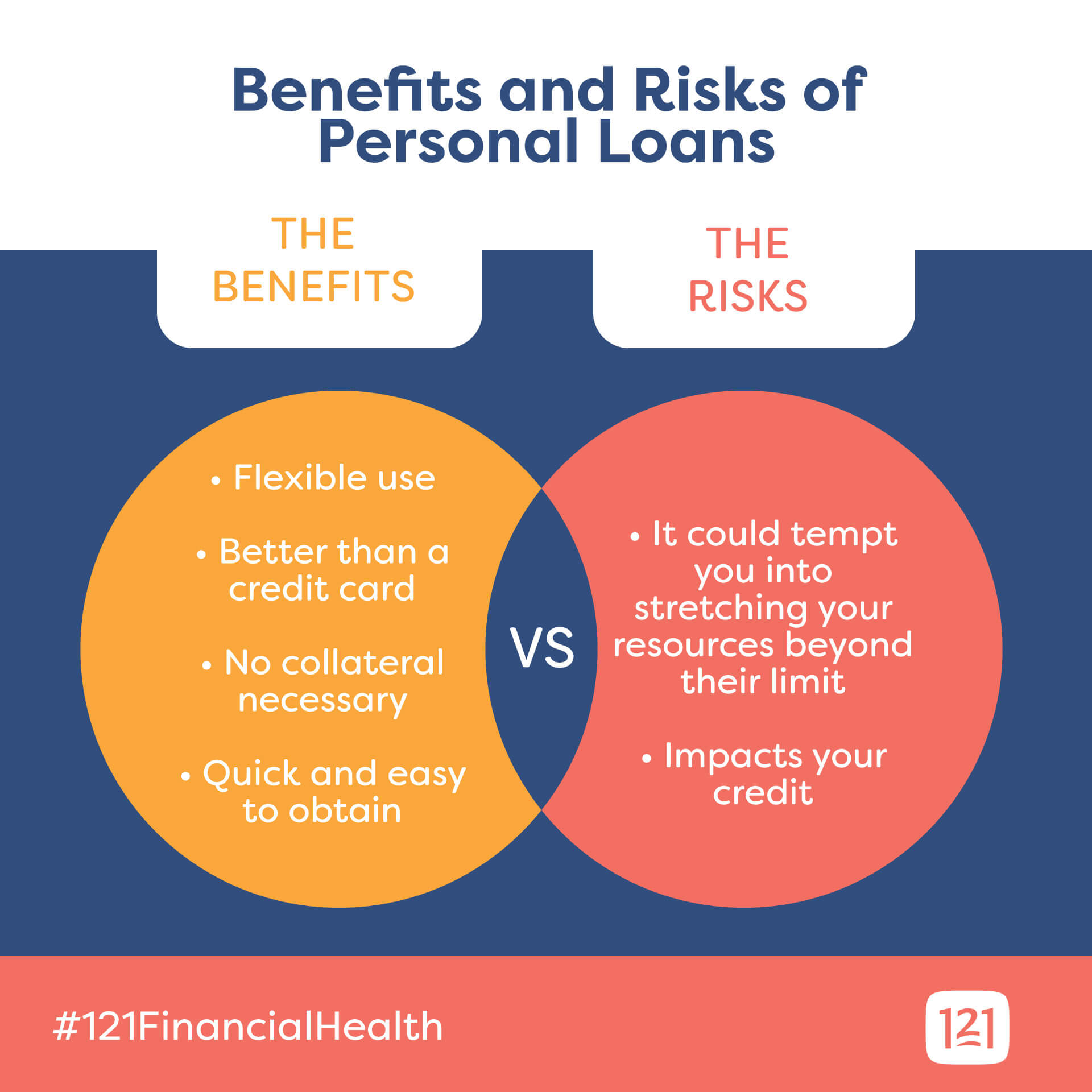

Sorts Of Individual Loans

When thinking about personal financings, individuals can choose from numerous types customized to fulfill their certain economic demands. One common type is the unprotected personal lending, which does not need security and is based on the debtor's credit reliability. These car loans commonly have higher rates of interest due to the increased threat for the lender. On the other hand, secured individual car loans are backed by security, such as a car or interest-bearing accounts, causing reduced interest prices as the loan provider has a kind of safety. For individuals aiming to combine high-interest financial obligations, a financial obligation loan consolidation funding is a feasible choice. This sort of lending combines several financial debts right into a solitary month-to-month payment, typically with a reduced rates of interest. Additionally, individuals in need of funds for home renovations or major acquisitions might select a home improvement lending. These car loans are especially developed to cover expenditures associated with boosting one's home and can be secured or unsecured relying on the lending institution's terms.

Benefits of Online Lenders

Understanding Cooperative Credit Union Options

Exploring the varied variety of credit union options can provide people with a valuable alternative when looking for economic services. Lending institution are not-for-profit monetary cooperatives that provide a variety of products and solutions similar to those of financial institutions, consisting of financial savings and inspecting accounts, finances, bank card, and much more. One essential difference is that credit score unions are possessed and operated by their members, that are likewise clients of the establishment. This possession structure often translates into reduced charges, affordable rate of interest on lendings and interest-bearing accounts, and a strong emphasis on customer service.

Credit history unions can be appealing to individuals trying to find an extra tailored technique to banking, as they commonly focus on member contentment over earnings. Furthermore, lending institution usually have a solid area existence and might supply economic education sources to assist participants enhance why not find out more their economic proficiency. By comprehending the options readily available at lending institution, individuals can make informed decisions concerning where to leave their economic needs.

Exploring Peer-to-Peer Borrowing

Peer-to-peer lending platforms have actually gotten popularity as a different form of loaning and investing recently. These systems attach individuals or organizations in need of funds with capitalists going to lend cash for a return on their financial investment. Among the essential attractions of peer-to-peer lending is the capacity for reduced rate of interest prices compared to conventional banks, making it an attractive alternative for consumers. Furthermore, the application procedure for obtaining a peer-to-peer lending is typically streamlined and can result in faster accessibility to funds.

Capitalists additionally gain from peer-to-peer financing by potentially gaining higher returns contrasted to standard financial investment alternatives. By eliminating the middleman, investors can directly money borrowers and obtain a portion of the passion settlements. It's vital to keep in mind that like any kind of financial investment, peer-to-peer lending lugs intrinsic threats, such as the possibility of borrowers defaulting on their loans.

Entitlement Program Programs

Amidst the advancing landscape of financial solutions, an essential aspect to think about is the world of Federal government Help Programs. These programs play an essential role in offering financial assistance and support to individuals and companies throughout times of demand. From unemployment benefits to bank loan, entitlement program programs aim to minimize monetary concerns and promote economic stability.

One noticeable instance of a federal government help program is the Small company Management (SBA) finances. These car loans use positive terms and low-interest rates to help small companies expand and navigate difficulties - best merchant cash advance. Furthermore, programs like the Supplemental Nutrition Aid Program (BREEZE) and Temporary Support for Needy Households (TANF) provide essential assistance for people and family members encountering economic hardship

Furthermore, government help programs extend beyond financial aid, encompassing housing support, medical care subsidies, and educational gives. These efforts aim to deal with systemic inequalities, advertise social well-being, and ensure that all people have accessibility to fundamental necessities and chances for improvement. By leveraging entitlement program programs, individuals and companies can weather financial tornados and aim in the direction of a much more safe financial future.

Verdict

Report this page